Hotel accounting can be defined as the process of managing the financial affairs of a hotel, including tracking revenue and costs, forecasting budgets, analyzing performance, and managing deposits.

This specialized area of accounting requires knowledge of hotel industry-specific regulations and an understanding of hotel operations and customer needs. Due to its complexity and importance to the hospitality industry, hotel accounting is typically overseen by accounting professionals with advanced degrees in finance or accounting.

When it comes to hotel accounting, there are a few key things you need to keep in mind to ensure successful and profitable operations.

In this blog post, we’ll cover building your accountant team, the typical issues hotel accountants face, and some tips to make the process easier.

Building Your Accountant Team

Having the right accounting team in place is crucial for successful hotel operations. Your team should include individuals experienced in:

- Payroll processing

- Expense tracking

- Financial auditing and reporting

- Market research for budgeting

By ensuring that you have the right people in place, you can minimize the chances of mistakes and ensure that your hotel’s finances are in good order.

Typical Issues Hotel Accountants Face

Though every hotel is slightly different, many face similar accounting issues that complicate financial management and reporting. Common issues include:

- Spending too much time on manual audits: Manual reconciliations are time-consuming and full of error potential. Automated audits ensure accuracy and allow staff to focus on other important areas of business operations.

- Non-stop operations make it difficult to keep up with accounting: Hotels operate 24/7 and with the non-stop flow of guests and the financial transactions that come with them, accurate night audits are crucial for smooth day-to-day transitions.

- Manual data entry can lead to human error and the loss of funds: With manual data entry comes the potential for mistakes, which can be costly.

- Using software that lacks the necessary integrations: Hotel data comes from multiple sources – online booking forms, in-person registration, customer loyalty programs, and more. If you don’t have the integrations to make it easy to tie all the data together, it can be hard to leverage your financial data and occupancy rate information to create competitive dynamic pricing. You need solutions that update in real-time, so you can act quickly for better decision-making.

- Dealing with diverse payroll rates: Staff members will have different payroll rates based on department, experience, benefits, full or part-time status, etc. Your front desk team will typically earn less than management.

- Dealing with diverse room rates: Various factors influence room rates, such as customer segment, day of week, room type, and hotel capacity. And when you have extra room charges for incidentals, things become even more complex.

Top Tips for Successful Hotel Accounting

It is essential to monitor hotel performance throughout the year and to work with your hotel managers to set annual budget objectives for each department.

Hotel professionals responsible for budgeting and financial monitoring must also be knowledgeable about hotel revenue management.

Invest in Revenue Management

Revenue management has become a vital tool for hotels looking to optimize their profitability. Making informed decisions about business processes, including using analytics and other business intelligence tools, is critical. The new era of hospitality is defined by insight based on experience and data. Revenue management leaders are guiding hotel operators through this transition.

Revenue management starts with a general strategy, which serves as the foundation for rates, policies, distribution, and marketing activities. To maximize profits, hoteliers must understand their customer’s preferences. They must develop a plan that caters to each segment of business.

Revenue management requires collaboration across departments. Revenue leaders must understand past and present trends to make informed decisions. They can compare historical data to current events by sharing information between departments. This information gives revenue managers real insight into rates and bookings.

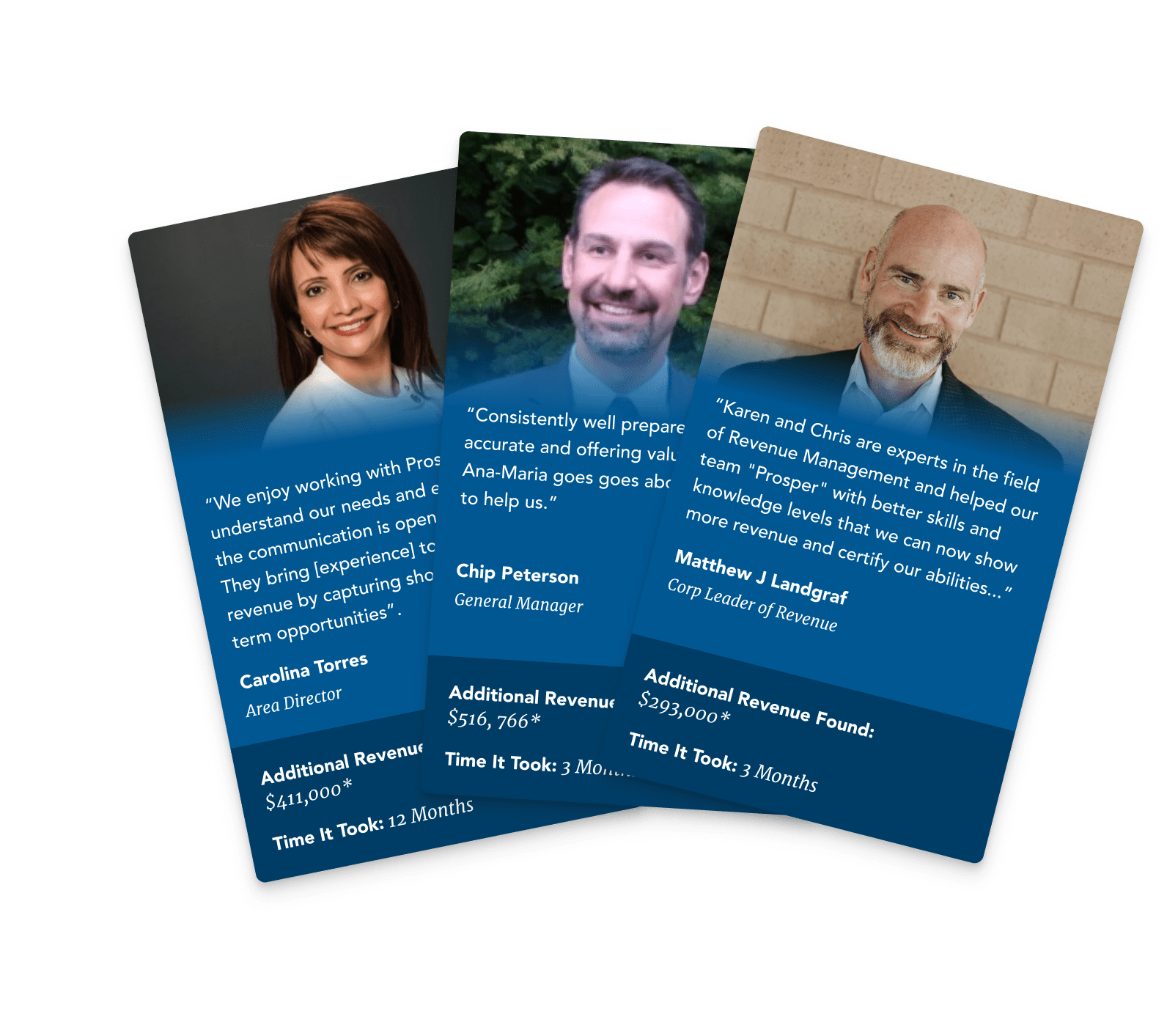

Prosper Hotels is an expert in revenue management. Our team can help you streamline operations using proven processes. Whether you manage a single boutique hotel or a large hotel group, we’ve got everything you need.

Streamline Night Audits

As a small business owner, it is crucial to streamline every aspect of your operations to stay competitive and efficient. One area in which small hoteliers can optimize their workflows is with night audits.

By utilizing streamlined software systems and minimizing the number of steps required for each audit, hotel owners can maximize their time and resources on more valuable endeavors.

A streamlined system allows staff to spend less time completing tasks, such as manually entering transactions into a ledger, freeing up time for tasks that require more attention and care. With these advantages in mind, it is clear that using technology to streamline your night audits can be essential for small hoteliers looking to stay ahead of the curve.

Select the Best Accounting Base

As a hotel owner or manager, you need the right hospitality accounting base to manage your business’s finances. You’ll need to choose between cash or accrual accounting, which sets the tone for your entire accounting system.

A good hotel accounting software should be flexible and allow for easy customization. These products include financial reports, financial statements (like balance sheets, cash flow statements, etc.) tax forms, and graphs that summarize data. Some of them also have project accounting capabilities.

The best hotel accounting software should have features that allow you to track revenue, track expenses, and manage staffing. The software should be flexible enough to handle multiple properties, room inventory, staffing, and payroll. It should also be compatible with your other systems, such as property management systems (PMS) and Labor Management, to get insights into labor costs for both full-time and part-time employees.

Accounting solutions like Quickbooks can help with bookkeeping and managing payroll and accounts payable, but unless your hotel management systems integrate with the accounting processes, you won’t be able to run your hotel business smoothly.

Utilize Individual Ledgers

A general ledger is an essential tool in the world of hotel accounting. This type of ledger keeps track of all the revenue sources for a hotel, including room rates, food and beverage sales, meetings and events, and more.

With each revenue stream recorded in its own individual ledger, it becomes possible to monitor performance and evaluate strategies on a granular level. Additionally, individual ledgers make detecting discrepancies or inaccuracies with bookings and billing easier.

For these reasons, many hotels are now moving toward using individual ledgers for each revenue source in their accounting systems. With this approach, they can gain greater insight into their performance and stay ahead of the competition in an increasingly competitive landscape.

Clean Up Your Reservations and Help Your Top Line Revenue with Prosper Revenue Management

Accounting is complex. Hotel accounting adds even more complexity.

Often, accounting is hyper-focused on reducing expenses to increase bottom line profitability. At Prosper, we’ll help you focus on the top line so you can save time, worry less about expenses, and see more profit.

With Prosper Hotels’ revenue management, you’ll have everything you need to make the most of your hotel finances. Contact us today to learn more about how we can help you reach your goals.

Drive More Hotel Revenue

Through Untapped Strategies

Drive More Hotel Revenue

Through Untapped Strategies